charitable gift annuity canada

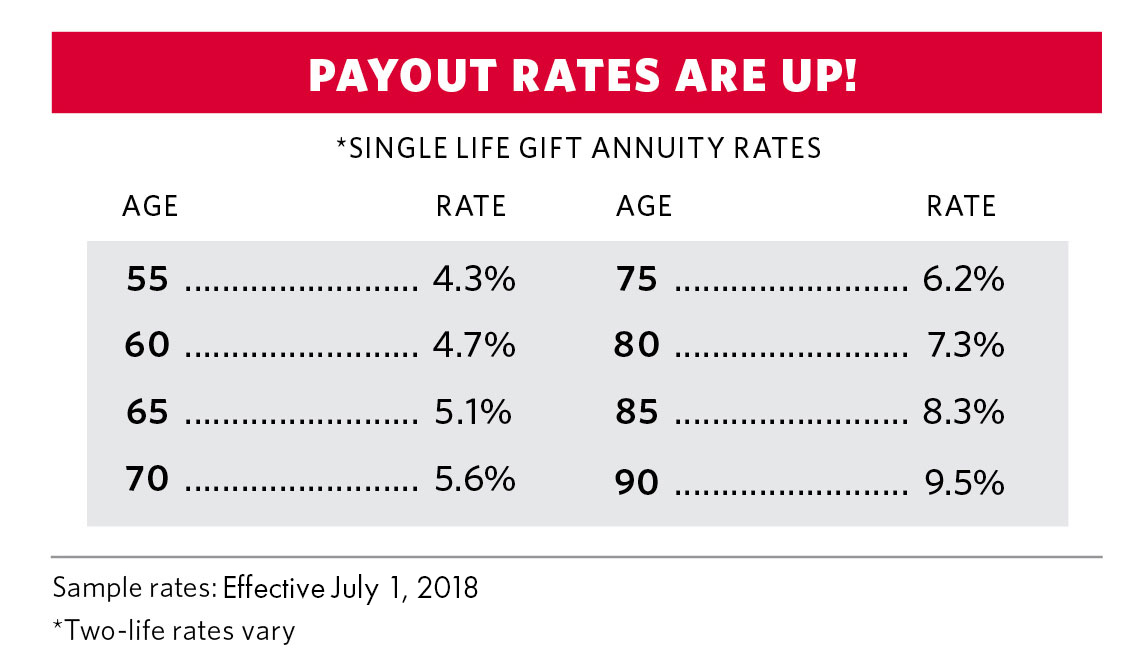

The following rates are examples only. 2021 Life Annuity Rates.

Charitable Gift Annuities Ppcli Foundation

Being this close to the end of the year the gift-giver may want to consider withholding 15000 or 30000 if married of the gift for January so as to avoid wasting their gift tax exemption.

. The work of art is property in the individuals inventory. Weve curated a list of 15 Canadian companies to keep on your charitable radar. The Income Tax Act however contains several income attribution rules that prevent Canadians from income splitting.

If the gift is property the property must have been purchased 12 months or more before making the donation. Mayme Patthoff Senior Director of Development 2164457834 email protected How You Can Help. For those that prefer an informal setting there is the Wright Place Café.

The Board meets at least annually to scrutinize the operation of the Corporation according to its Objects and ensure that the organization operates according to its By-laws. Shared by residents visitors and staff the Café is a cafeteria-style self-serve dining area open from 700 am. For personal annuity rates please use our Annuity Quote Form.

Include a Jewish Agency Gift Annuity as part of your fixed-income or retirement planning and lock in a high fixed lifetime rate much of which may be paid to you tax-free and an income tax charitable deduction. Male Annuity Rates. The Board consists of the Apostolic Chancellor Archbishop of Toronto five bishops from across Canada and five Catholic lay persons.

Since Canada has a graduated income tax system the idea is to reduce the overall family burden. Company Name Starting with. 190 Under subsections 11817 and 71 an individual will only be able to make a designation under subsection 118171 in respect of a charitable gift of a work of art to a qualified donee where.

Based on current guidance it is our understanding that whole of life WOL protection policies with surrender values are excluded in certain circumstances from registering with the Trust Registration Service TRSTherefore provided that no surrenders are made on the WOL policy during the life assureds lifetime the trust will not be required to register for TRS purposes. It must be established and resident in Canada operate for charitable purposes and devote its resources. Under the special rule of Regulations section 202010-2a7ii executors of estates who are not required to file Form 706 under section 6018a but who are filing to elect portability of the DSUE amount to the surviving spouse are not required to report the value of certain property eligible for the marital deduction under section 2056 or.

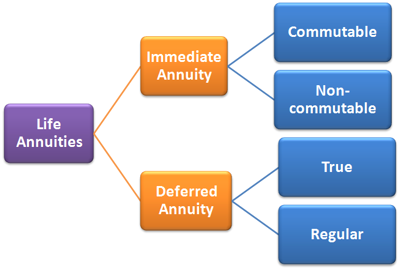

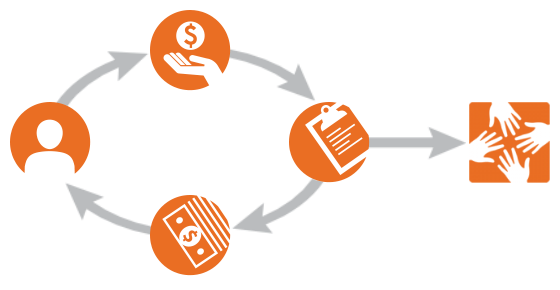

2022 Life Annuity Rates. If you gift your spouse part of your income theyll still attribute it back to you and youll be taxed at the higher rate. A charitable gift annuity is an arrangement under which a donor transfers capital to a charitable organization in exchange for immediate guaranteed payments for life at a specified rate depending on life expectancy or for a fixed term.

Focusing on organizations working to improve the lives of Canadas youth as well as those conducting disease research Air Canada consider requests for cash donations and sometimes will even donate promotional flight tickets. You can help by making a contribution in a variety of ways. Your gift or donation must be worth 2 or more.

The most you can claim in an income year is. Annuity Rates as of March 26 2022. We quote from all the top leading insurance companies in Canada.

2022 Best Annuity Rates in Canada Annuity Comparison Tables March 26 2022. You must have made the gift or donation as an individual not in the course of carrying on a business and it cant be a testamentary donation. The work of art is of the individuals own creation.

Lorem ipsum dolor sit amet consectetur adipisicing elit sed do eiusmod tempor incididunt ut labore et dolore magna aliqua. Soaring Indspires annual Indigenous Youth Empowerment Gathering is THE place for Indigenous high school students to learn about career and post-secondary education options by participating in career workshopsTheyll also learn more about financial support and meet Canadas top employers. To request more information about making a charitable gift call or send an email to.

Soaring 2022 marks the 10th year Indspire has held the event and will. The Rivers to Success program provides a supportive learning environment for First Nations Inuit and Métis students at key stages of their educational journey giving them the tools they need to complete their education and successfully pursue the career of their dreams. Basic Search To select a company use one of the following options.

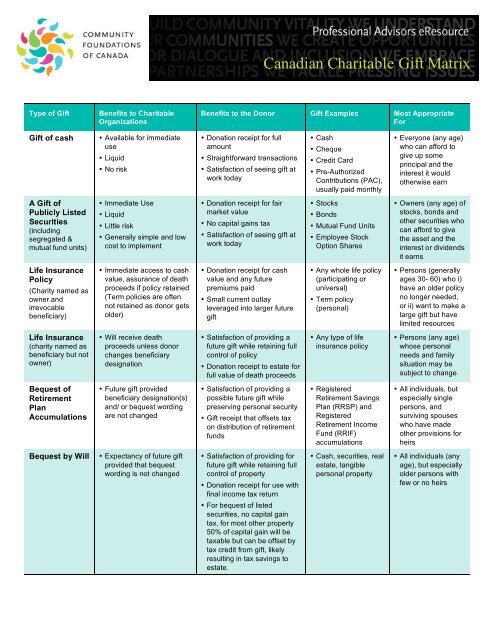

Cash gifts usually in the form of checks are the most popular type of charitable contribution.

Charitable Gift Annuities Citadel Foundation

Charitable Gift Annuity Focus On The Family

Charitable Gift Annuity The Christian School Foundation

Charitable Gift Annuities Studentreach

Canadian Charitable Gift Matrix Community Foundations Of Canada

Http Www Valamohaniyercharitabletrust Com Annadan Html Free Food Providing Functions Are Every Month Amavasai Trust Words Charitable Charity Organizations

Charitable Gift Annuity Focus On The Family

Charitable Donations Structuring Gifts With Passive Retirement Income Advisor S Edge

Charitable Gift Annuity Focus On The Family

Charitable Remainder Trusts Crts Wealthspire

Tax Advantages For Donor Advised Funds Nptrust

Planned Giving Habitat For Humanity Sarnia Lambton Habitat For Humanity Lambton Habitats

How Do Charitable Gift Annuities And Charitable Remainder Trusts Work Northern Trust

Charitable Gift Annuity Partners In Health

How Do Charitable Gift Annuities And Charitable Remainder Trusts Work Northern Trust

Legacy How To Leave Your Legacy At The Jewish Community Alliance

How Do Charitable Gift Annuities And Charitable Remainder Trusts Work Northern Trust